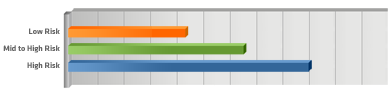

Invest in Government and Corporate Bonds, small amount in cash but higher portion invested into Equities and property.

Small element of Bonds, higher level of investment in Equities, will consider small element of investment in emerging markets, some investment in Commodities, Currency Fund and Property.

High portion invested into Equities with a percentage invested in Emerging markets and Commodities. Small element in Property

Whatever short term or long term financial goals you have most of us will need to save for them. You might be saving for your first home, a holiday, or your children's education, if so, getting into a regular savings habit can give you more options for the future. The stock market has the potential to offer the possibility of greater rewards than Deposit Accounts.

Although, choosing when to invest can often be difficult and sometimes daunting, especially when investment markets are volatile. By getting into a regular savings habit you reduce some of the risks associated with one-off investments in the stock market.

We provide a range of protection options including protection for your home, income, family and business.

Take control of your retirement and plan for the future with a pension from R&L Financial Services.

Income Protection financially safeguards you and your family against long-term illness or injury.